What is Systematic Withdrawal Plan?

Systematic Withdrawal Plan (SWP) is a feature offered by mutual funds where an investor can withdraw a fixed amount of money from their mutual fund investment at regular intervals, such as, monthly, quarterly or annually. This is most commonly used, instead of a fixed deposit, by retirees and individuals seeking regular income from their investments.

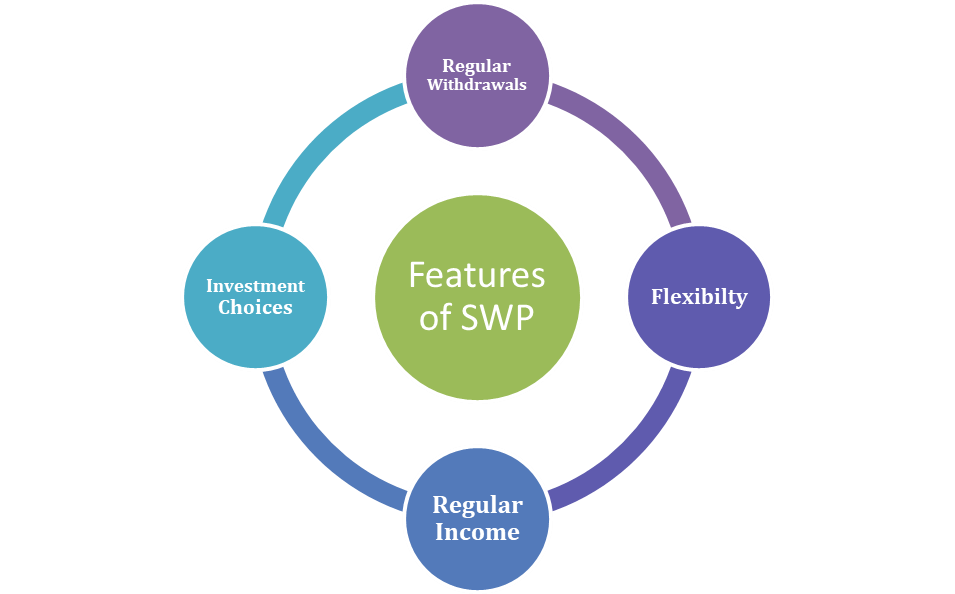

Features of SWP

The key features of SWP are as follows:

1. Regular Withdrawals: It provides the facility to withdraw a predetermined amount at regular intervals from their investment. The amount can be withdrawn monthly, quarterly or annually.

2. Flexibility: Investors can choose the interval period for withdrawal and also the amount for withdrawal. They can adjust the withdrawal amount and interval period subject to the limits set by the funds or financial institution.

3. Regular Income: SWPs provide regular income to the investor and at the same time preserve the principal amount invested.

4. Investment Choices: Investors can choose from a wide variety of investment options such as equity funds, debt funds, hybrid funds, etc. Investors can choose the fund that aligns with their goals and risk tolerance.

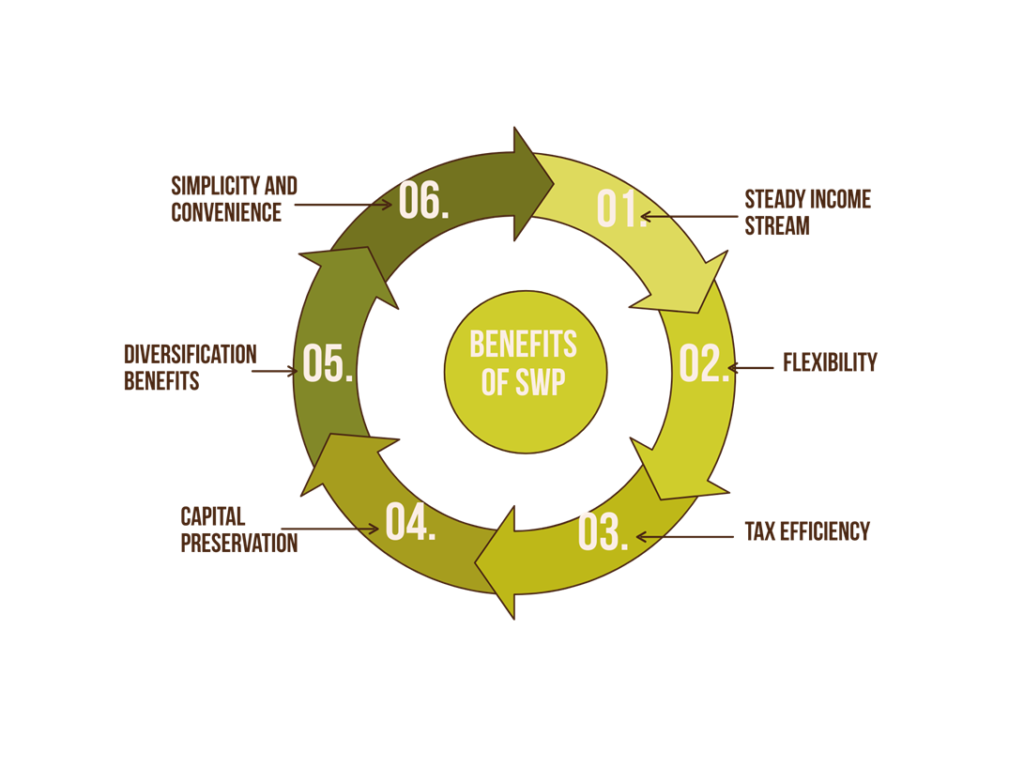

Benefits of SWP

Which is Better SWP or Fixed Deposit (FD)?

While SWP may be suited for those who want a steady stream of returns and are willing to accept fluctuating returns, whereas, FDs are suitable for those who want a guaranteed income with low risk and are willing to lock away their money for a certain period of time. It is better to choose whether you want a SWP or FD after considering your risk tolerance, financial goals, etc. Consulting a financial advisor can help you make informed decisions.

Conclusion

In conclusion, SWPs offer a dynamic strategy for generating regular income from their investments. Through SWPs investors can fix their interval period and withdrawal amount to meet their financial needs and goals, providing a steady stream of income and at the same time preserving the initial principal amount. By understanding the features and benefits associated with SWPs, investors can make informed decisions and achieve their long term financial goals.

Example:

SBI Large and Midcap Fund

SWP illustration 10 years

Investment Amount- *50 lakhs*

Investment Date-01/01/2014

SWP start Date- 10/02/2014

Monthly SWP withdrawal

- Rs.33333(approximately 8% of investment)

Current Value – 1.55 Crs

SWP withdrawal – 39.66 lakhs

Returns – 17.78%

*Mutual Funds are subject to market risks, read all scheme related documents carefully.