Startups often require significant funding to scale, develop innovative products and gain market traction. While bootstrapping and bank loans are common funding options, venture capital (VC) remains one of the most powerful growth accelerators for high-potential startups. Venture capital not only provides financial backing but also brings industry expertise, strategic guidance, and crucial networking opportunities. However, it comes with trade-offs, including equity dilution and investor expectations for high returns.

In this blog, we will explore what venture capital is and how it works, different stages of venture capital funding, the advantages and challenges of VC investment and the impact of VC on startup growth and success.

What is Venture Capital?

Venture capital is a form of private equity investment where institutional investors, firms, or individuals provide funding to startups and small businesses in exchange for equity. These investors, known as venture capitalists (VCs), seek high-growth businesses with the potential for significant returns.

Unlike traditional bank loans, VC funding is equity based, meaning startups don’t have to repay the funds directly. Instead, VCs make their returns when the startup scales and either goes public (IPO) or is acquired by a larger company.

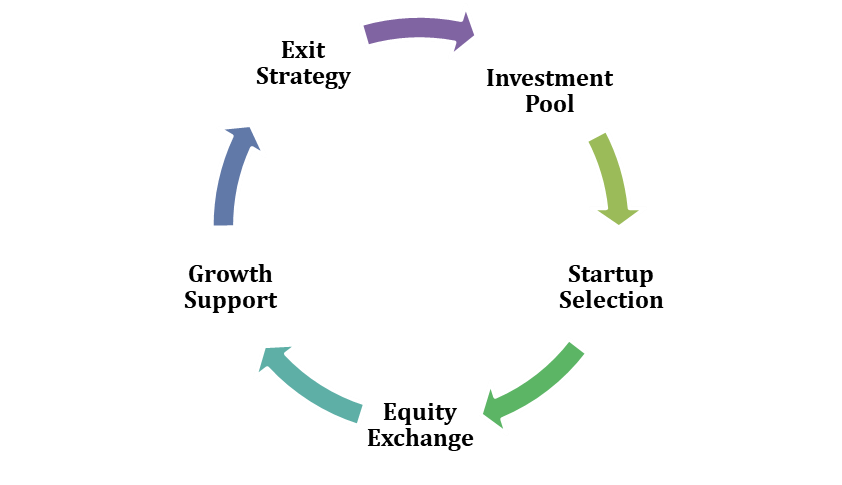

How Venture Capital Works

- Investment Pool: VC firms raise capital from institutional investors (pension funds, endowments, high-net-worth individuals) to create a fund.

- Startup Selection: VCs evaluate startups based on market potential, business model, and scalability.

- Equity Exchange: Startups receive capital in return for a percentage of ownership.

- Growth Support: VCs actively mentor and support the startup to increase its valuation.

- Exit Strategy: VCs sell their stake via an IPO, merger, or acquisition for high returns.

Example: Sequoia Capital, one of the world’s most successful VC firms, invested in early-stage startups like Google, Apple, Airbnb and WhatsApp, helping them become multi-billion-dollar companies.

Stages of Venture Capital Funding

Startups go through multiple funding rounds as they grow. Each stage serves different business needs:

1. Pre-Seed Funding (Idea Stage)

- Purpose: Product development, market search and initial team formation.

- Investors: Angel investors, incubators, accelerators, friends and family.

- Typical Investment: ₹10 lakh – ₹1 crore.

Example: A tech startup building an AI-driven app might receive funding from a startup incubator to develop a prototype.

2. Seed Funding (Early Growth Stage)

- Purpose: Launching the product, hiring key staff, and testing market viability.

- Investors: Angel Investors, early stage VC firms.

- Type Investment: ₹1 crore – ₹10 crore.

Example: Zomato raised $1 million on its Series A round to expand its food discovery platform.

3. Series B & C Funding (High Growth Stage)

- Purpose: Market dominance, acquiring competitors, launching global expansion.

- Investors: Late stage VC firms, private equity investors.

- Typical Investment: ₹100 crore – ₹500 core.

Example: Flipkart’s Series C funding helped it expand logistics and build its private label brands.

4. Series D & Beyond (Pre-IPO Stage)

- Purpose: Preparing for an IPO, scaling internationally, final expansion efforts.

- Investors: Private equity, hedge funds, sovereign wealth funds.

Example: Byju’s raised billions in the late stage funding before planning its IPO.

5. Exit (IPO or Acquisition)

- Purpose: Investors cash out by selling shares in the stock market or through an acquisition.

Example: Facebook acquired Instagram for $1 billion

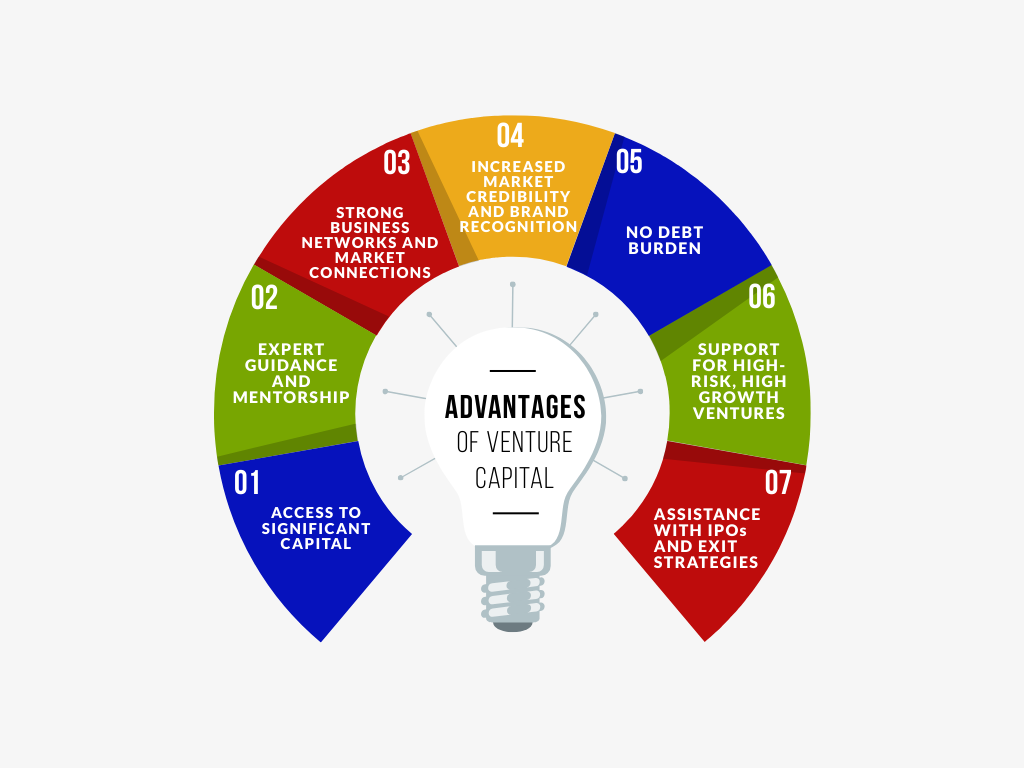

Advantages of Venture Capital

Venture capital (VC) plays a crucial role in helping startups scale and achieve long-term success. Unlike traditional financing methods, venture capital provides not only funding but also strategic support, mentorship, and access to valuable networks. While VC funding comes with the trade-off of giving up equity, the benefits it offers often outweigh the risks, especially for high-growth startups. Given below are the key advantages of venture capital and how it helps startups achieve rapid growth and market dominance.

1. Access to Significant Capital

One of the biggest advantages of venture capital is that it provides startups with access to substantial funding. Unlike traditional bank loans, which often require collateral and have strict repayment terms, venture capital does not impose immediate financial burdens.

Why is this important for startups?

- Startups usually require large amounts of capital to develop their products, expand their teams, and scale their operations.

- Many early-stage businesses do not have steady revenue streams, making traditional financing options risky and less accessible.

- Venture capital enables companies to invest in long-term growth without the pressure of immediate repayments.

Example: In its early stages, Uber secured venture capital funding from Benchmark Capital and Sequoia Capital. This funding allowed Uber to expand rapidly into multiple cities, develop its mobile app, and build a strong infrastructure before generating consistent revenue. Without VC funding, Uber might have struggled to scale at such a rapid pace.

2. Expert Guidance and Mentorship

Venture capitalists bring more than just money to the table. They are experienced investors with deep industry knowledge and strong business acumen. Many VCs are former entrepreneurs or executives who understand the challenges of building a startup.

How does this benefit startups?

- Strategic Planning – VCs help refine business models, set achievable goals, and develop effective growth strategies.

- Operational Expertise – Startups gain access to best practices in finance, marketing and technology.

- Crisis Management – VCs provide guidance during downturns, helping startups navigate market uncertainties.

Example: When Airbnb faced regulatory challenges in multiple cities, its venture capital investors, including Andreessen Horowitz, helped the company negotiate with local governments and develop legal frameworks that allowed it to operate legally. This strategic mentorship helped Airbnb expand globally and become a market leader in short-term rentals.

3. Strong Business Networks and Market Connections

Venture capital firms have extensive networks, which can open doors to valuable business opportunities. This includes connections with:

- Potential customers and clients

- Industry leaders and corporate partners

- Other investors for future funding rounds

- Experienced executives who can join as advisors or board members

For startups, these connections can be instrumental in securing business deals, strategic partnerships, and high profile collaborations.

Example: In 2014, when WhatsApp received funding from Sequoia Capital, it gained access to influential Silicon Valley contacts, which eventually led to its $19 billion acquisition by Facebook. Without these networks, securing such a high-profile exit would have been much more difficult.

4. Increased Market Credibility and Brand Recognition

Startups backed by reputable venture capital firms gain instant credibility in the market. This can help in multiple ways:

- Building trust among customers – A well-funded startup is often perceived as more reliable.

- Attracting the talent – Skilled professionals prefer to work for companies with financial stability.

- Gaining media exposure – VC backed companies receive more press coverage, increasing their visibility.

Example: When Byju’s, the Indian ed-tech giant, received funding from Sequoia Capital and Tencent, it gained widespread recognition as a top-tier educational platform. This credibility helped it attract millions of users, secure partnerships with universities, and expand internationally.

5. No Immediate Debt Burden

Unlike traditional loans, venture capital does not require startups to repay funds immediately. Instead, investors receive a share of equity in exchange for their investment.

How does this help startups?

- Preserves cash flow – Startups can use their capital for business growth rather than repaying loans.

- Allows for aggressive expansion – Companies can focus on scaling without worrying about monthly repayments.

- Reduces financial risk – If the startup fails, there is no obligation to repay the investors.

Example: SpaceX, founded by Elon Musk, raised over $1 billion in venture capital to fund its ambitious space exploration projects. Since these projects required long-term research and development, traditional loans would not have been a viable option due to their short repayment cycles. VC funding allowed SpaceX to innovate without immediate financial constraints.

6. Support for High-Risk, High-Growth Ventures

Many startups operate in industries that involve significant risk and high upfront costs, such as biotechnology, artificial intelligence, and fintech. Banks and traditional lenders are often hesitant to fund such business due to their uncertainty. Venture Capitalists, however, are willing to take calculated risks in exchange for high potential returns. They look for disruptive businesses that can dominate their markets.

Example: Tesla, which aimed to revolutionize the electric vehicle industry, faced skepticism from traditional investors due to the high production costs and market uncertainties. However, early VC backers, including Draper Fisher Jurvetson, believed in Tesla’s vision and provided funding, which helped the company scale and eventually become a global leader in sustainable transportation.

7. Assistance with IPOs and Exit Strategies

One of the ultimate goals of venture capital investment is to help startups achieve a successful exit, either through:

- Initial Public Offering (IPO) – Going public and raising capital from stock markets.

- Mergers & Acquisitions (M&A) – Selling the company to a larger corporation.

Venture capitalists actively assist in these processes by:

- Preparing the company for public listing.

- Connecting with investment banks and legal advisors.

- Structuring deals to maximize the company’s valuation.

Example: Facebook received funding from Accel Partners and Greylock Partners, who played a crucial role in helping the company, go public in 2012. The IPO raised over $16 billion, making it one of the largest tech IPOs in history.

Disadvantages of Venture Capital for Startups

While venture capital (VC) can provide essential funding for high-growth startups, it comes with several challenges that entrepreneurs must carefully evaluate before seeking investment. Below are the key disadvantages of venture capital funding:

1. Loss of Ownership and Control

One of the biggest trade-offs of venture capital is equity dilution. When startups receive funding, they give away a portion of ownership in exchange for capital. As investors acquire more equity, founders may lose decision-making authority over their own business. This can be particularly concerning if venture capitalists (VCs) demand board seats or influence strategic choices, potentially steering the company in a direction that differs from the founder’s vision.

Example: Many early-stage founders of tech companies, such as Steve Jobs (Apple) and Travis Kalanick (Uber), eventually lost control of their businesses due to conflicts with investors and board members.

2. High Expectations for Rapid Growth

Venture capitalists invest in startups with the expectation of significant and rapid returns. They often push for aggressive scaling strategies, which can lead to premature expansion. If a startup grows too quickly without a solid foundation, it may face operational inefficiencies, cash flow issues, or an inability to meet customer demands.

Example: Many startups that received large VC investments, like WeWork, expanded rapidly without achieving sustainable profitability, leading to massive financial losses and valuation crashes.

3. Time-Consuming and Competitive Process

Securing venture capital is a lengthy and challenging process. Founders must spend months preparing detailed business plans, financial projections, and pitch presentations. Investors conduct thorough due diligence, evaluating the market opportunity, financials, team expertise, and competitive landscape before making a decision. The process can take months or even years, diverting the founder’s focus from running the business.

Example: Airbnb’s founders pitched their business idea to multiple investors and faced numerous rejections before finally securing funding. The process was lengthy and required persistence.

4. Pressure to Exit

VC firms invest with a clear objective: to achieve a significant return on their investment, typically within 5–10 years. This often means pushing for an exit strategy such as an IPO (Initial Public Offering) or acquisition, even if the founder wants to continue growing the company independently. In some cases, this pressure can force a sale at an unfavourable time or valuation.

Example: Many startups, such as WhatsApp and Instagram, were acquired earlier than their founders may have intended due to pressure from investors looking for returns.

5. Potential Conflicts with Investors

Once venture capitalists invest in a startup, they gain a vested interest in how the company is managed. While their experience and mentorship can be valuable, conflicts may arise if investors and founders disagree on business strategies, spending priorities, or exit plans. These disagreements can lead to internal disputes, slowing down decision-making and even resulting in founders being removed from their own companies.

Example: In the case of Twitter, co-founder Jack Dorsey was removed as CEO due to boardroom conflicts, highlighting how investor influence can reshape company leadership.

6. Loss of Flexibility and Autonomy

Bootstrapped businesses and those funded through alternative means (such as small business loans) maintain full autonomy over decision-making. However, when a company takes VC funding, it must align its strategies with investor expectations. This often means prioritizing short-term growth and revenue targets rather than focusing on long-term innovation, sustainability, or gradual expansion.

Example: Some startup founders have expressed regret over taking VC funding, as they felt pressured to prioritize rapid expansion over the core values and mission of their business.

Conclusion

Venture capital not only provides funding but also offers strategic mentorship, valuable industry connections, and operational expertise, accelerating a startup’s growth. For high-growth startups aiming to scale rapidly, VC funding can be a game-changer, offering the capital needed to expand into new markets, develop innovative products, and attract top talent.

However, venture capital is not without its challenges. Startups must be prepared to give up equity, relinquish some control, and meet the high expectations of investors who seek substantial returns. The funding process can also be highly competitive, requiring a solid business model, a scalable growth strategy, and a compelling vision.

Ultimately, whether or not to pursue venture capital depends on a startup’s goals, risk tolerance, and long-term strategy. While it can provide the financial fuel for exponential growth, it’s essential for founders to carefully evaluate the trade-offs and ensure that the partnership aligns with their vision for the company’s future.