When it comes to building wealth and achieving financial freedom, one principle stands out as a game-changer: compound interest. Often called the “eighth wonder of the world”, compound interest is a powerful financial concept that rewards patience and time. By understanding how it works and the importance of starting early, you can unlock significant financial growth over time.

In this blog, we will explore the magic of compound interest and why starting your investment journey early is crucial.

What is Compound Interest?

Compound interest is the interest earned not only on the initial principal of an investment or a loan, but also on the accumulated interest from previous periods. Essentially, it’s “interest on interest,” allowing your money to grow exponentially over time.

The power of compounding helps money grow faster compared to simple interest, which is calculated only on the principal amount. The greater the number of compounding periods, the greater the compound interest growth will be. For savings and investments, compound interest is your best friend, as it helps multiply your money at an accelerated rate.

How Compound Interest Works

Compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate, raised to the power of the number of compounding periods, minus one. The total initial principal is then subtracted from the resulting value.

Here’s how it works:

- Simple Interest: Interest is calculated only on the principal amount.

- Compound Interest: Interest is calculated on both the principal and the previously earned interest.

The formula for compound interest is:

A = P * (1 + r/n)nt

Where:

- A = Final Amount

- P = Principal Amount

- r = Annual Interest Rate (in decimal form)

- n = Number of times interest is compounded per year

- t = Number of Years

Example:

Imagine you invest ₹10,000 in an account that offers an 8% annual interest rate, compounded annually.

- After 1 year: ₹10,000 × (1 + 0.08) = ₹10,800

- After 2 years: ₹10,800 × (1 + 0.08) = ₹11,664

- After 10 years: Your investment grows to ₹21,589 without any additional deposits!

Now, imagine investing ₹10,000 every year—your wealth will multiply significantly over time.

Why Start Investing Early?

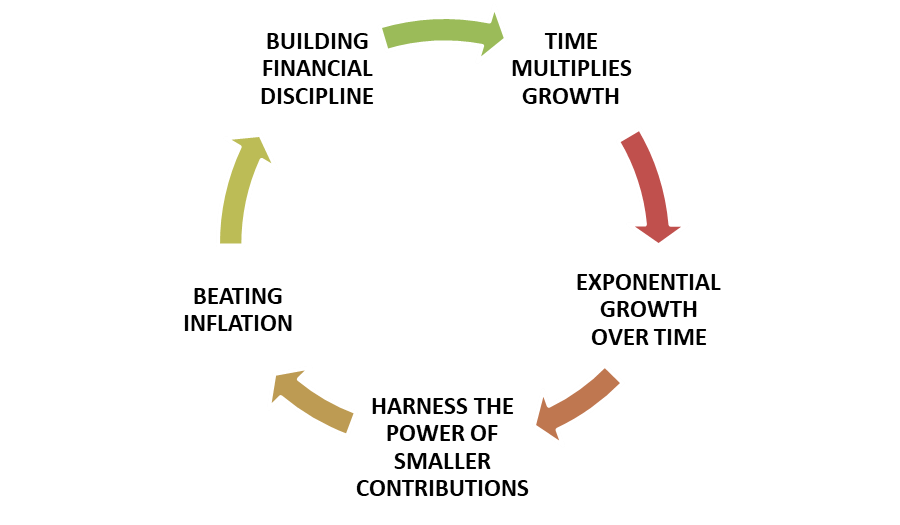

The earlier you start, the more time your money has to grow. Here is why starting early is a game changer:

- Time Multiples Growth: The longer your money remains invested, the more compounding works in your favor. Even small amounts invested early can grow into substantial wealth over the decades. For example, Person A invests ₹10,000 annually starting at age 25 for 10 years (total investment: ₹1,00,000). Person B invests ₹10,000 annually starting at age 35 for 20 years (total investment: ₹2,00,000). Assuming a 10% annual return, the final value of Person A’s investment will be ₹16,44,940 and that of Person B’s will be ₹11,49,735. Despite Person A investing for fewer years and a lower total amount, they end up with more money due to the power of compounding.

- Exponential Growth over Time: At first, compound interest may seem slow, but over the long term, growth accelerates exponentially. The key is to stay invested and allow compounding to do the heavy lifting.

- Smaller Contributions Yield Big Results: Starting early means you can invest smaller amounts consistently and still achieve financial goals. Waiting too long may force you to invest much larger sums later to reach the same target.

- Beating Inflation: Inflation erodes the purchasing power of money over time. By investing early, your returns can outpace inflation, ensuring your purchasing power remains strong.

- Building Financial Discipline: Early investing cultivates the habit of saving and helps develop financial discipline – a key ingredient for long-term wealth creation.

The Cost of Delaying Investments

Every year you delay investing, you miss out on potential compounded growth. To reach the same financial goal later, you would need to invest significantly larger amounts.

For instance, if you want ₹1 crore by age 60:

- If you start at age 25, you need to invest only ₹3,000 per month (assuming a 12% annual return).

- If you start at age 35, you must ₹10,000 per month to achieve the same goal.

The lesson? The earlier you start, the less financial burden you carry!

Steps to Leverage Compound Interest

- Start Now: Time is your greatest asset. Even small investments can grow into substantial wealth over time.

- Invest Consistently: Make investing a habit. Even during market downturns, continue investing – consistency beats timing the market.

- Choose Growth-Oriented Investments: Choose stocks, mutual funds or index funds, which offer higher long-term returns compared to fixed deposits.

- Reinvest earnings: Ensure that dividends, interest and gains are reinvested to maximize compounding.

- Stay Committed: Avoid premature withdrawals – compounding rewards those who remain patient.

Pros and Cons of Compound Interest

Compound interest is a powerful tool for growing wealth over time, but like any financial concept, it has both advantages and disadvantages. Understanding these can help you make informed decisions about how to manage your money. Here is a breakdown:

| PROS AND CONS OF COMPOUND INTEREST | |

| PROS | CONS |

| Exponential Growth | Slow Growth Initially |

| More Wealth with Less Effort | Requires Patience |

| Small Investments Grow Big | Can Lead to Debt |

| It Works in your favor for Long-term Investments | Dependent on Interest Rates |

| Compounding can work in your favor when making loan payments | Can be Misunderstood |

| Helps Outpace Inflation | |

Pros of Compound Interest

- Exponential Growth: The primary benefit of compound interest is its ability to generate exponential growth. The interest earned compounds over time, meaning that your wealth grows faster as interest is calculated on both the initial principal and the accumulated interest. Over the long-term, this can lead to significant returns on your investment.

- More Wealth with Less Effort: With compound interest, you don’t need to actively reinvest the earnings or manage the investment. The process of compounding takes care of itself. Once you set your money in motion, it can grow without additional effort, making it ideal for long-term financial goals like retirement or saving for large purchases.

- Small Investments Grow Big: Even small, consistent contributions can lead to substantial growth over time. The power of compounding amplifies the impact of investments, meaning that starting early, even with small amounts, can result in a larger end balance.

- It Works in Your Favor for Long-term Investments: The longer you leave your money remains invested, the more it compounds, leading to greater wealth accumulation. This is especially advantageous in retirement accounts, where long-term investments often yield impressive returns.

- Compounding can work in your favor when making loan payments: When you make more than your minimum payment, you can leverage the power of compounding to save on total interest.

- Helps Outpace Inflation: Investing in assets that generate compound interest can help you stay ahead of inflation. As inflation erodes the purchasing power of your money, compound interest can generate returns that outpace inflation, preserving and growing your wealth.

Cons of Compound Interest

- Slow Growth Initially: Although compound interest grows exponentially over time, the growth rate can appear slow in the early years. This can be discouraging for investors who expect rapid returns, especially if they have a short term investment horizon.

- Requires Patience: The beauty of compound interest lies in time, and it requires patience. If you are not willing to wait for years or decades to realize the full benefit, compound interest may not be ideal choice. Investors looking for quick returns may find the slow build-up frustrating.

- Can lead to Debt: While compound interest can benefit savers and investors, it can work against borrowers. If you have outstanding debts like credit cards or loans with high interest rates, the compound interest on those debts can quickly escalate, leading to overwhelming debt if left unpaid.

- Dependent on Interest Rates: For compound interest to be effective you need to earn a decent rate of return. In low interest environments, the power of compounding is diminished. If your investments don’t yield sufficient returns, compound interest may not significantly grow your wealth.

- Can be Misunderstood: Compound interest can be complex, especially if you are unfamiliar with it accumulates over time. The long-term growth of compound interest may be misleading if you don’t fully grasp how the interest is calculated, leading to unrealistic expectations. However, once understood and applied wisely, compound interest becomes one of the most powerful financial tools for wealth building

Conclusion

The power of compound interest lies in time and patience. Starting your investment journey early not only reduces the burden of large contributions but also helps you achieve financial goals with greater ease. Remember, time in the market is more important than timing the market.

So, take the first step today – no matter how small. Your future self will thank you for the decision to let time and compounding work their magic.