Starting a business is an exciting journey, but it often comes with its share of challenges, particularly in securing funds. This is where startup loans come into play. These loans provide the capital needed to bring your entrepreneurial dreams to life, covering expenses such as equipment, office space, and initial operations. In this blog, we dive deep into the world of startup loans, exploring their types, benefits, application process, and the indispensable role of a project report in securing one.

What are Startup Loans?

Startup loans are tailored financial products designed to assist new entrepreneurs in launching their businesses. They help bridge the financial gap for startups, offering funds to handle everything from initial costs to scaling operations. Unlike personal loans, startup loans are specifically structured to cater to the unique needs of businesses, providing flexibility and support for growth.

Types of Startup Loans

Startup loans can be broadly categorized into the following types:

- Bank Loans: Offered by traditional banks, these loans often come with competitive interest rates but may require collateral and a detailed project report.

- Government-Sponsored Schemes: Programs like PMEGP (Prime Minister’s Employment Generation Programme) and MUDRA (Micro Units Development and Refinance Agency) offer funding tailored for small businesses and startups.

- Angel Investors and Venture Capital: Non-traditional funding options where investors provide capital in exchange for equity, suitable for innovative and scalable business ideas.

- Microfinance Institutions: Ideal for small-scale startups, these institutions focus on providing smaller loan amounts with fewer formalities.

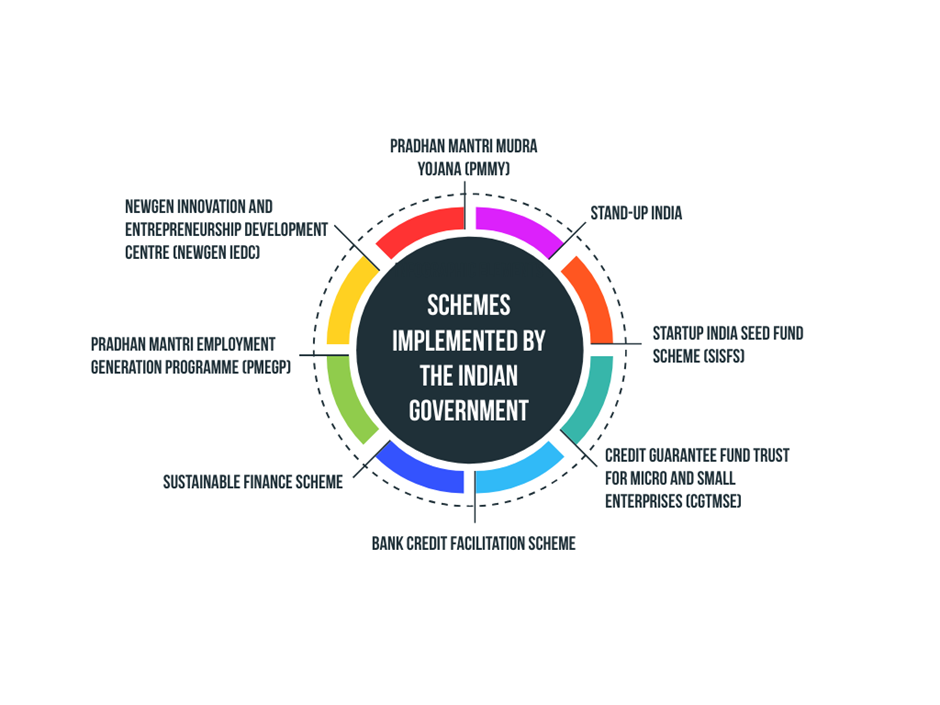

Schemes Implemented by the Indian Government

The Indian government has implemented numerous schemes to empower startups and MSMEs (Micro, Small, and Medium Enterprises). These initiatives aim to provide financial support, foster innovation, and enable entrepreneurship across various sectors. Here is a detailed overview of key government schemes for startups:

1. Pradhan Mantri Mudra Yojana (PMMY): Launched in 2015, this scheme provides financial assistance to non-corporate, non-farm small/micro-enterprises.

- Loans are categorized into three segments:

- Shishu: Loans up to ₹50,000 for businesses in the initial stages.

- Kishor: Loans above ₹50,000 up to ₹5,00,000 for expanding existing businesses.

- Tarun: Loans above ₹5,00,000 up to ₹10,00,000 for well-established businesses.

2. Stand-Up India: Introduced in 2016, this scheme promotes entrepreneurship among women and SC/ST individuals.

- Features:

- Loans ranging from ₹10 lakh to ₹1 crore.

- Maximum repayment tenure: 7 years with a moratorium of up to 18 months.

- Can be used for setting up greenfield projects in manufacturing, trading, or services.

3. Startup India Seed Fund Scheme (SISFS): This scheme provides financial support to startups for prototype development, market entry, and commercialization.

- Features:

- Seed funding of up to ₹50 lakh.

- Disbursed through eligible incubators.

- Covers costs like product trials, market-entry activities, and proof of concept.

4. Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE): This scheme provides collateral-free credit to new and existing MSMEs.

- Features:

- Loan limit: Up to ₹2 crore.

- Coverage includes term loans and working capital.

- Managed by the Ministry of MSME and SIDBI.

5. Bank Credit Facilitation Scheme: Operated by the National Small Industries Corporation (NSIC), this scheme helps MSMEs meet their credit needs by partnering with various banks.

- Features:

- Loan tenure ranges from 5 to 7 years and can be extended to 11 years for special cases.

- No direct lending; NSIC facilitates loans from partner banks.

6. Sustainable Finance Scheme: Aimed at promoting green and sustainable development projects, this scheme is managed by SIDBI.

- Features:

- Financial support for projects involving renewable energy, energy efficiency, and clean production.

- Encourages sustainable development by supporting the entire value chain.

7. Pradhan Mantri Employment Generation Programme (PMEGP): This scheme supports the establishment of micro-enterprises in rural and urban areas.

- Features:

- Maximum loan amount: ₹25 lakh for manufacturing units and ₹10 lakh for service units.

- Subsidy: 15%-35%, depending on the location and beneficiary category.

- Loans can be used for purchasing machinery, tools, or other business-related expenses.

8. NewGen Innovation and Entrepreneurship Development Centre (NewGen IEDC): This scheme encourages innovation-driven entrepreneurship among students.

- Features:

- Provides financial assistance for prototype development.

- Facilitates the establishment of incubation centers in academic institutions.

- Offers mentorship and technical support to budding entrepreneurs.

Why These Schemes Are Crucial for Startups

- Financial Support: Provides initial funding to turn innovative ideas into successful businesses.

- Ease of Access: Simplifies credit access through digital platforms and partnerships with banks.

- Inclusive Growth: Encourages participation from underrepresented groups like women and SC/ST individuals.

- Sustainable Development: Promotes environmentally friendly business practices.

- Market Exposure: Enables startups to participate in trade fairs and access global markets.

Eligibility Criteria for Startup Loans

Startup loans in India have varying eligibility, depending on the lender. However, there are general requirements that most lenders may request, such as:

- Business Plan or Project Report: A comprehensive document outlining your business’s goals, strategy, and financial projections.

- Registration and Licensing: Proof that your business is legally registered and holds any required licenses.

- Creditworthiness: Good personal and business credit history to assure lenders of your repayment ability.

- Collateral: Some loans may require assets as security, especially for larger amounts.

The Role of Project Reports in Obtaining Loans

A project report is the cornerstone of a successful loan application. It provides lenders with an in-depth understanding of your business and it’s potential. A well-crafted project report includes:

- Executive Summary: A concise overview of your business objectives and strategies.

- Market Analysis: Insights into the target audience, industry trends, and competitive landscape.

- Financial Projections: Detailed revenue forecasts, expense estimates, and profitability metrics.

- Operational Plan: Step-by-step strategies for achieving business milestones.

- Repayment Plan: A clear outline of how and when the loan will be repaid.

Professionally prepared project reports not only increases your credibility but also demonstrates preparedness and reduce perceived risks for lenders.

Steps to Apply for Startup Loan

- Research Loan Options: Compare different lenders and schemes to identify the most suitable one for your business.

- Gather Documentation: Prepare a thorough project report along with other necessary documents such as identity proofs, business registration certificates, and financial statements.

- Submit Application: Present your application and project report to the lender.

- Engage in Follow-Up: Respond promptly to lender queries and provide additional information if needed.

- Loan Disbursement: Upon approval, the funds are released, and you can start utilizing them for your business needs.

General Requirements and Documentation

Each lender may demand different requirements and documentation. However, it is important to have the following documents before applying for a startup loan in India:

- Proof of identity: An Aadhar Card, Passport, Driving Licence, or PAN Card is required to prove your identity.

- Address proof: A proof of address can be provided whether with a copy of a signed lease agreement, a copy of a mortgage statement or a utility bill is required.

- Photographs: Prepare passport-size photographs.

- Business proof: an ITR, udyam certificate, trade license, GST certificate, or other forms of business proof is required.

- Bank statements: A copy of your bank statements for the last 6 months is required.

- Proof of income: Provide your income tax returns (ITR) or other relevant documentation.

- Signature proof: Provide your bank-verified signature or your signature on a valid ID card.

- Banking details: Present a copy of the first page in your bank account’s passbook.

Benefits of Startup Loans

Startup loans offer multiple advantages, such as:

- Capital Infusion: Enables you to handle startup costs and operational expenses.

- Flexible Terms: Offers repayment schedules tailored to your business’s cash flow.

- Improved Credit Score: Timely repayments help establish a strong business credit profile.

- Business Growth: Supports expansion and scaling opportunities.

Why Choose a Professional for Project Report Preparation?

Creating a project report requires expertise in financial forecasting, market research, and strategic planning. Professionals ensure that your report meets lender requirements and effectively communicates your business potential. This can make all the difference in securing your loan.

Conclusion

Startup loans are a vital resource for entrepreneurs aiming to establish their businesses. A well-prepared project report is your ticket to unlocking these funds and turning your vision into reality. Don’t leave this critical task to chance — reach out to professionals for assistance in crafting a project report that stands out.