In the world of business, working capital is a fundamental concept that plays a crucial role in ensuring smooth day-to-day operations. Despite its importance, it’s a term that is often misunderstood or overlooked, especially by budding entrepreneurs. In this blog, we will break down what working capital is, why it matters, and how to manage it effectively.

What is Working Capital?

Working capital, also known as net working capital (NWC), is the difference between a company’s current assets- like cash, accounts receivable/ customer’s unpaid bills, and inventories of raw materials and finished goods and its current liabilities, such as accounts payable and debts. It’s a commonly used measurement to gauge the short term financial health and efficiency of an organization. It is a financial metric that indicates the liquidity levels of business for managing day-to-day expenses.

Importance of Working Capital

Working capital is vital for business as it ensures smooth day-to-day operations by covering short term financial obligations such as payroll, inventory purchases and utility bills. Sufficient working capital allows businesses to seize growth opportunities, respond to unexpected expenses and navigate economic downturns. It also helps businesses to maintain healthy cash flow, which is essential for meeting financial obligations and sustaining operations in the long term. Effective management of working capital enhances financial risk and contributes to overall business stability and resilience in dynamic market environments.

Types of Working Capital

Working Capital, a measure of a company’s short term liquidity, can be categorized into different types based on its components, duration and purpose. Understanding these distinctions helps businesses to manage their finances more effectively and adapt to varying operational needs. Below is a detailed explanation of the types of working capital:

Based on Components

This classification focuses on the elements that constitute working capital.

- Gross Working Capital: It refers to the total current assets of a business. It highlights the company’s short term resources available for operations, such as, cash, accounts receivable and inventory.

- Net Working Capital: It is calculated as the difference between current assets and current liabilities. It represents the surplus or deficit after meeting short term liabilities.

Based on Purpose

This classification is about the specific reasons for which the working capital is utilized.

- Regular Working Capital: It refers to the funds needed for the routine operations of the business, such as paying salaries, purchasing inventory or covering utility bills.

- Reserve Working Capital: It refers to an additional amount set aside to meet any sudden and unforeseen emergencies or market changes.

Based on Nature of Business

Different businesses require varying levels and types of working capital based on their operational models.

- Fixed Working Capital: This is the minimum working capital essential for running the business continuously, similar to permanent working capital.

- Variable Working Capital: It refers to the changes based on the scale of operations or market conditions, similar to temporary working capital.

Formula for Calculating Working Capital

To calculate working capital, subtract a company’s current liabilities from its current assets. Both figures can be found in a company’s’ financial statements.

Working Capital = Current Assets – Current Liabilities

The result of this calculation indicates the company’s ability to meet its short term obligations. Positive working capital indicates a company can easily cover its short term obligations and invest in operations, reflecting its financial efficiency, while negative working capital indicates potential liquidity issues.

Positive and Negative Working Capital

A business can either have positive or negative working capital;

- Positive Working Capital: When the result of the calculation is positive, it indicates that the company’s current assets exceed its current liabilities. The company has more than enough resources to cover its short term debt and some leftover cash if all current assets are liquidated to pay this debt.

- Negative Working Capital: When the result of the calculation is negative, the company’s current assets are insufficient to cover its current liabilities. This is a warning that the company has more short term debt than short term resources. It typically indicates poor short term health, low liquidity and potential problems in paying its debt obligations.

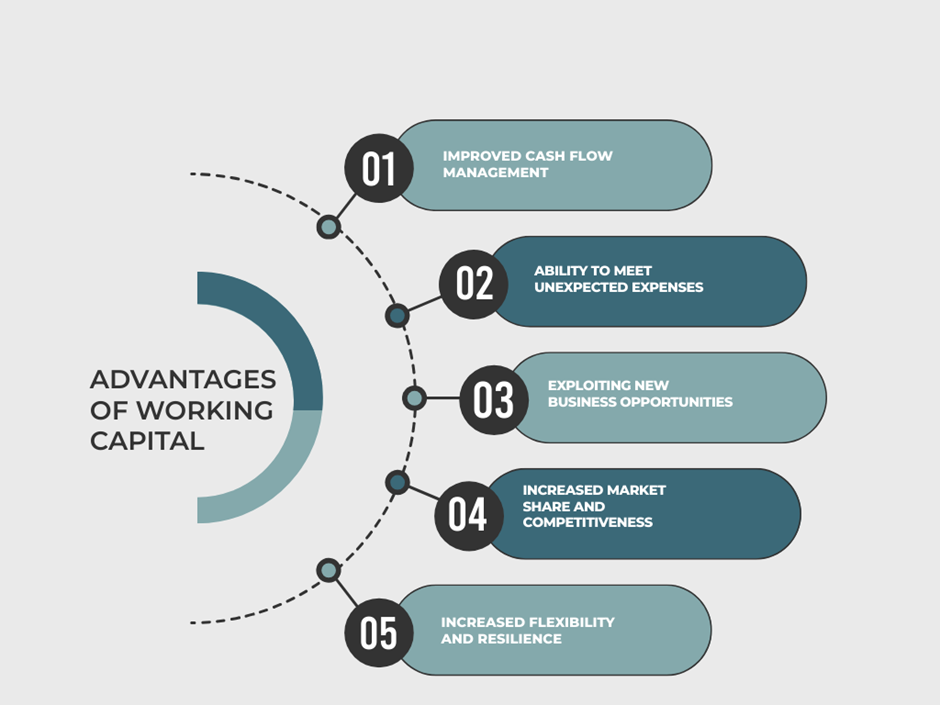

Advantages of Working Capital

Having adequate working capital is essential for the smooth functioning and financial stability of any business. It provides a buffer against uncertainties and supports growth initiatives. Below are the key advantages of maintaining sufficient working capital:

- Improved Cash Flow Management: Proper working capital ensures a steady inflow and outflow of cash, enabling a business to meet its short term financial obligations like paying suppliers, wages and utilities.

- Ability to Meet Unexpected Expenses: Businesses with adequate working capital can handle unforeseen costs such as emergency repairs, legal fees or sudden increases in raw material prices.

- Exploiting New Business Opportunities: Sufficient working capital provides the financial flexibility to invest in growth opportunities, such as entering new markets, launching new markets or investing in research and development.

- Increased Market Share and Competitiveness: A business with adequate working capital can meet customer demand consistently and maintain high service levels, boosting its reputation and customer loyalty.

- Increased Flexibility and Resilience: A business with strong working capital can adapt quickly to changing economic conditions, such as recessions, inflation or supply chain disruptions.

Limitations of Working Capital

While working capital is crucial for a business’s short term financial health, it is not without its limitations. Over reliance on or mismanagement of working capital can lead to inefficiencies and challenges. Here are the key limitations of working capital:

- Does Not Reflect Long Term Financial Stability: Working capital is a measure of a company’s short term liquidity and does not account for long term financial health or solvency. A company may have adequate working capital but still struggle with long-term debt or insufficient investments in fixed assets.

- Limited Insight into Profitability: Working capital indicates liquidity but doesn’t measure operational efficiency or profitability. A business may appear to have strong working capital but operate at a loss, which is unsustainable in the long run.

- Can Be Misleading Due to Poor Quality of Assets: The value of current assets like inventory or accounts receivable may not reflect their true realizable value. Out-dated inventory or bad debts in accounts receivable can distort the actual working capital position.

- Vulnerable to Market Volatility: Working capital is sensitive to market conditions such as economic downturns, raw material price fluctuations, or changes in customer demand. These fluctuations can destabilize working capital, making it unreliable in volatile industries.

- Overemphasis May Hinder Long-Term Growth: Excessive focus on maintaining high working capital can limit investments in long-term projects. This can slow down innovation, expansion, or modernization.

- Dependency on Short-Term Financing: Businesses with inadequate working capital often rely on short-term borrowing, leading to higher interest costs and financial strain. Over-reliance on short-term loans can increase the risk of default and reduce profitability.

Conclusion

Working capital is a cornerstone of any business’s financial health, ensuring smooth day-to-day operations and providing the flexibility to manage short term obligations and seize growth opportunities. From understanding its meaning and importance to exploring its types, formula, advantages, and limitations, it becomes evident that effective working capital management is not just about maintaining liquidity but also about optimizing resources for operational efficiency and long-term success.

While it has its limitations, such as its focus on short-term finances and susceptibility to market fluctuations, these can be addressed through accurate data analysis and strategic planning. By maintaining a balanced working capital, businesses can not only sustain their operations but also build resilience against uncertainties and pave the way for sustainable growth.

Ultimately, working capital is more than just a financial metric—it’s a strategic tool that, when managed effectively, can drive profitability, competitiveness, and stability for any business.